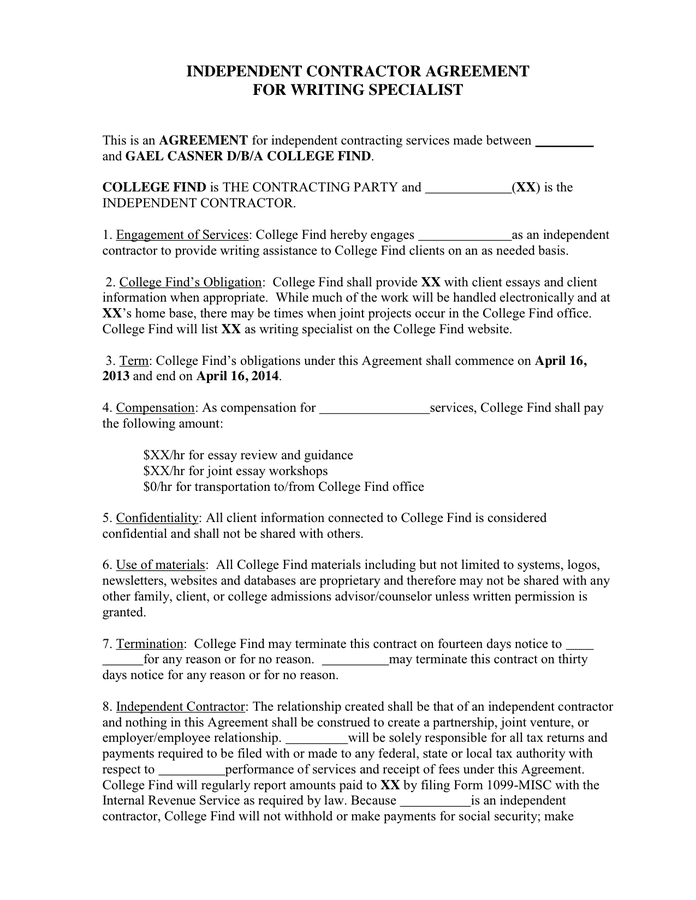

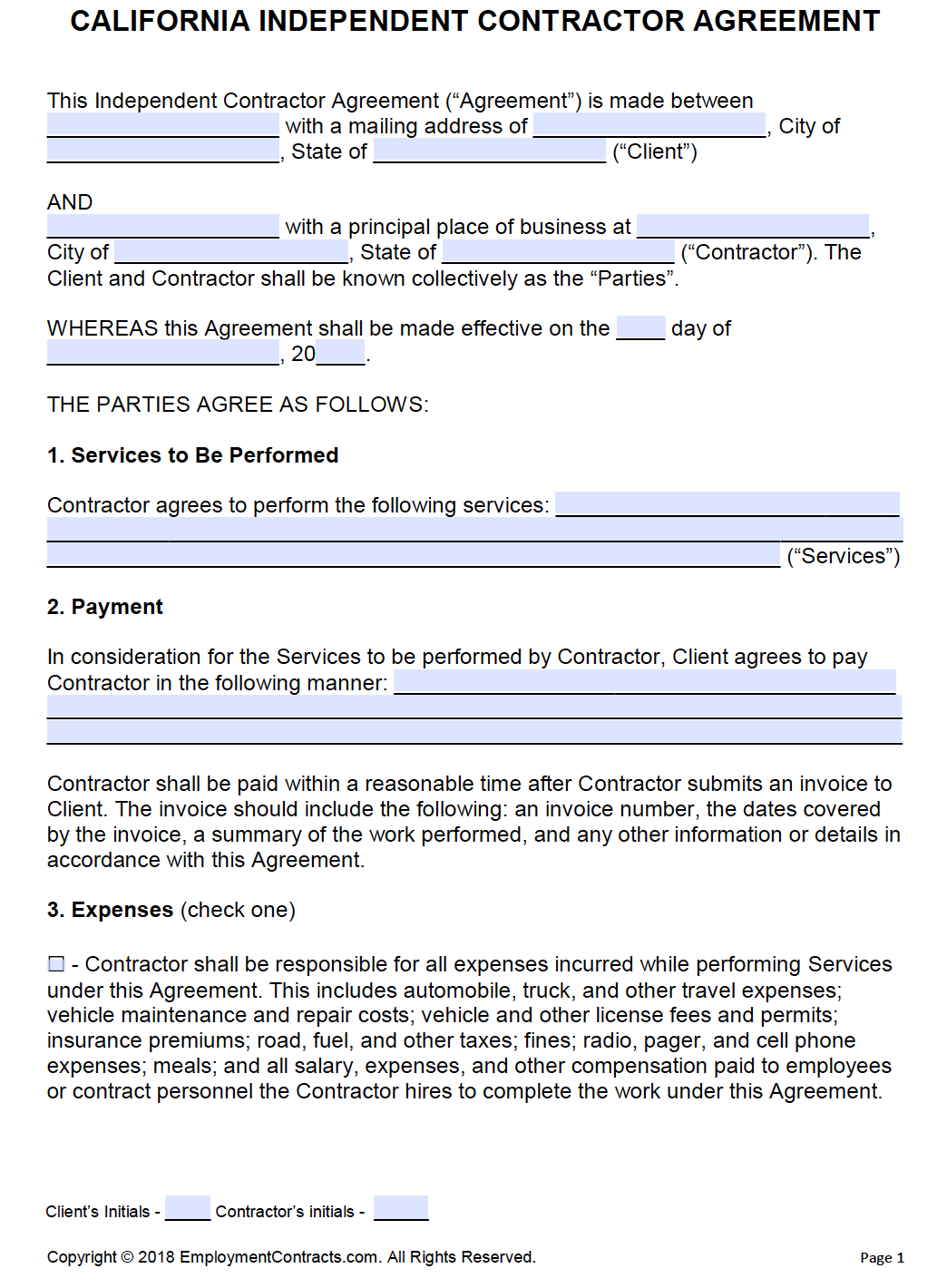

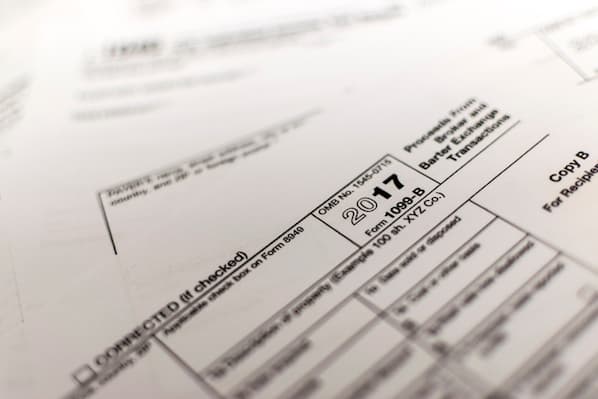

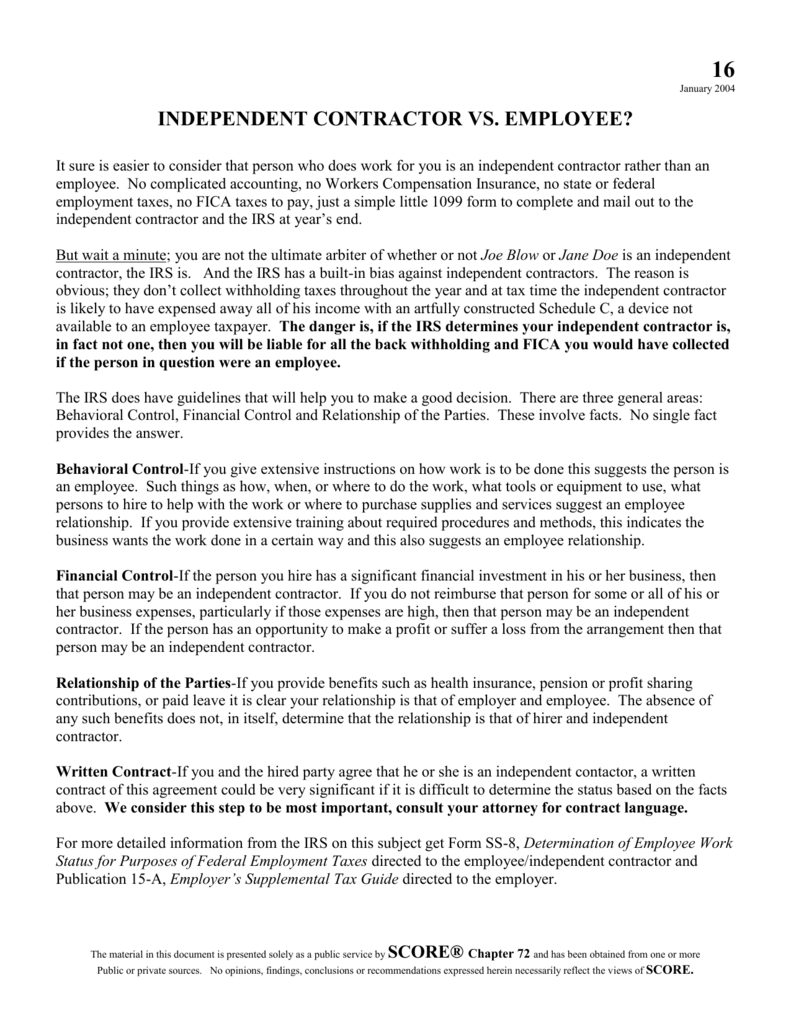

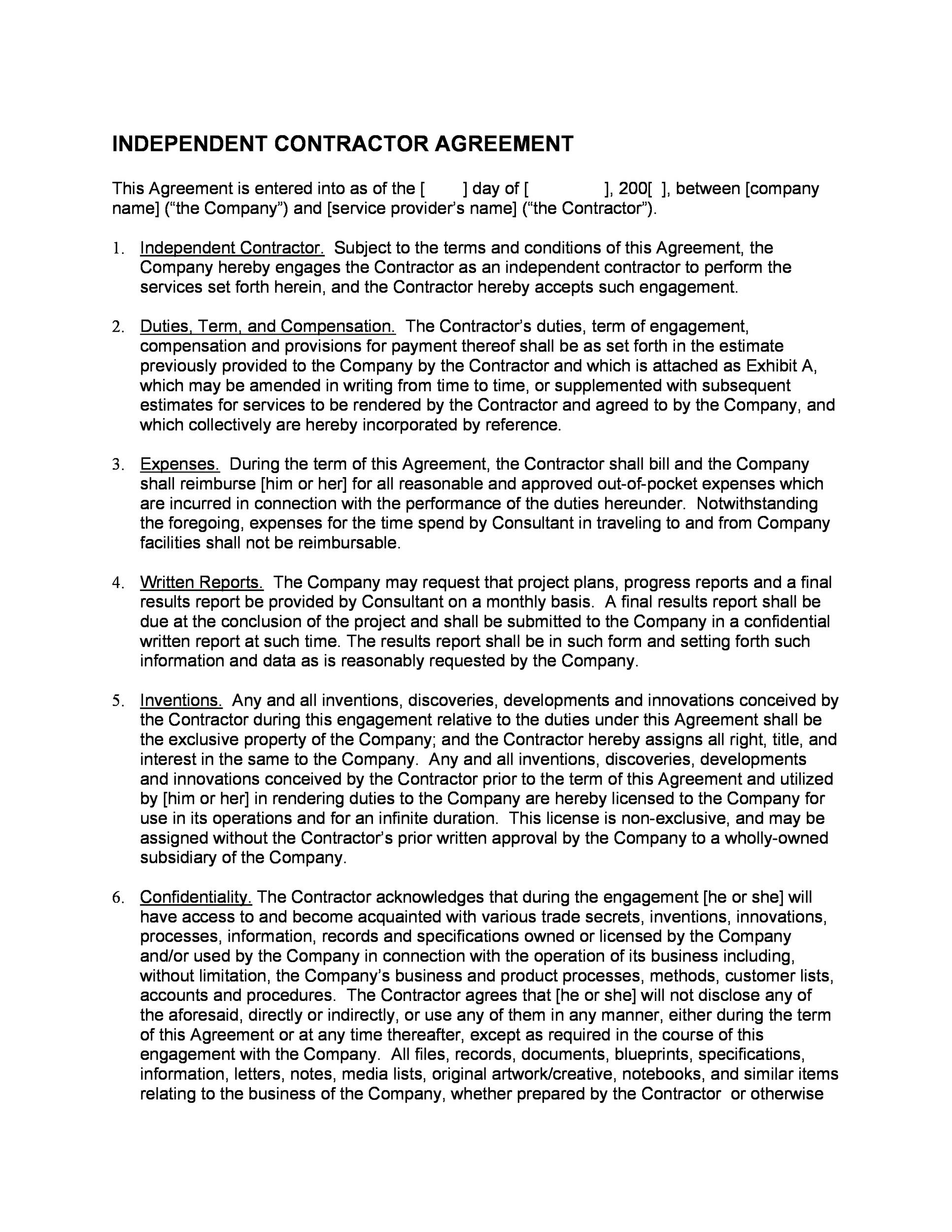

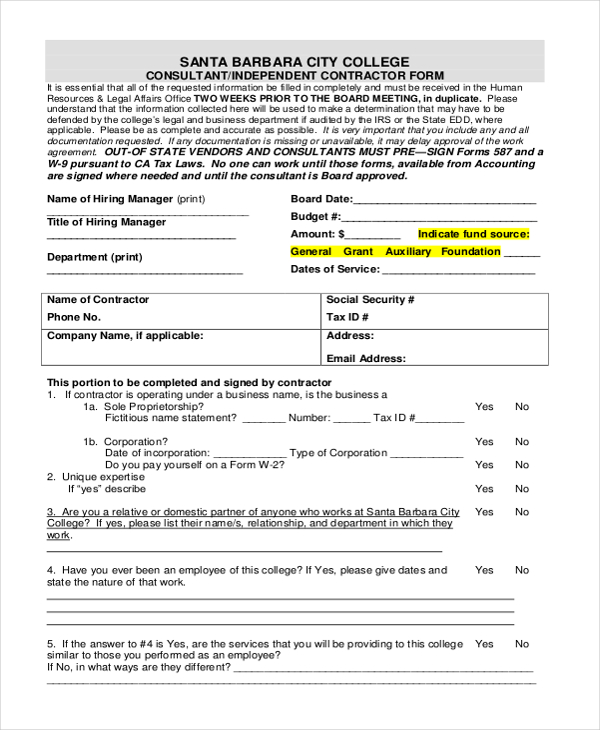

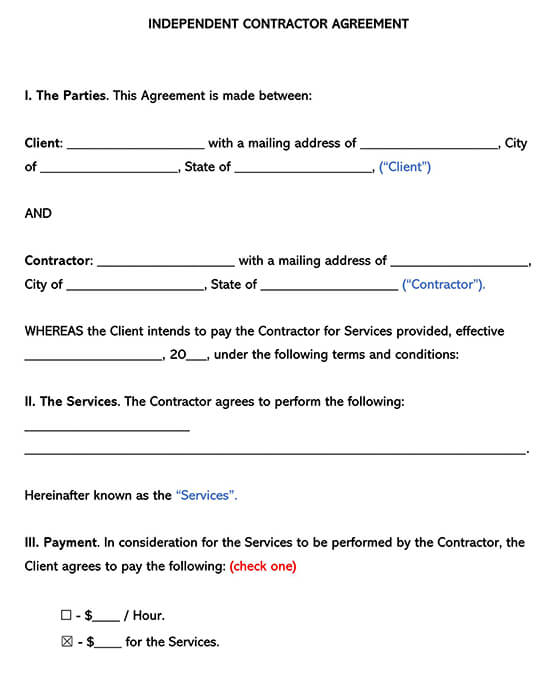

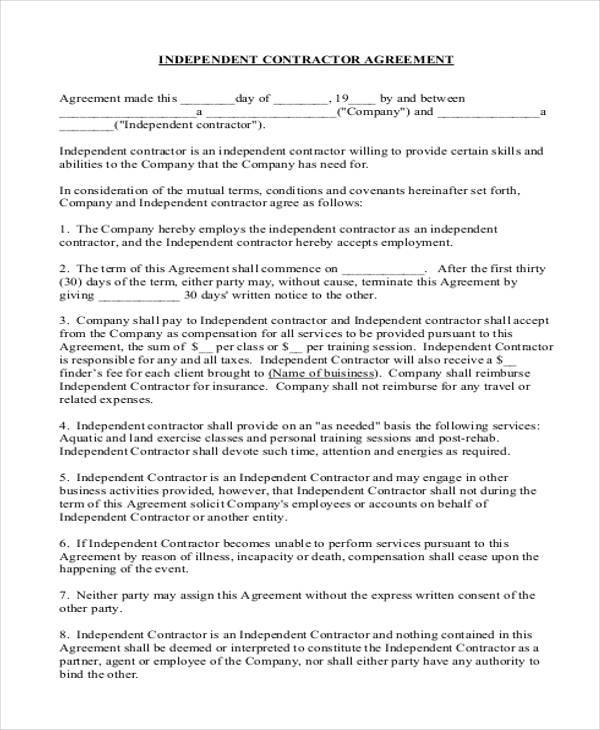

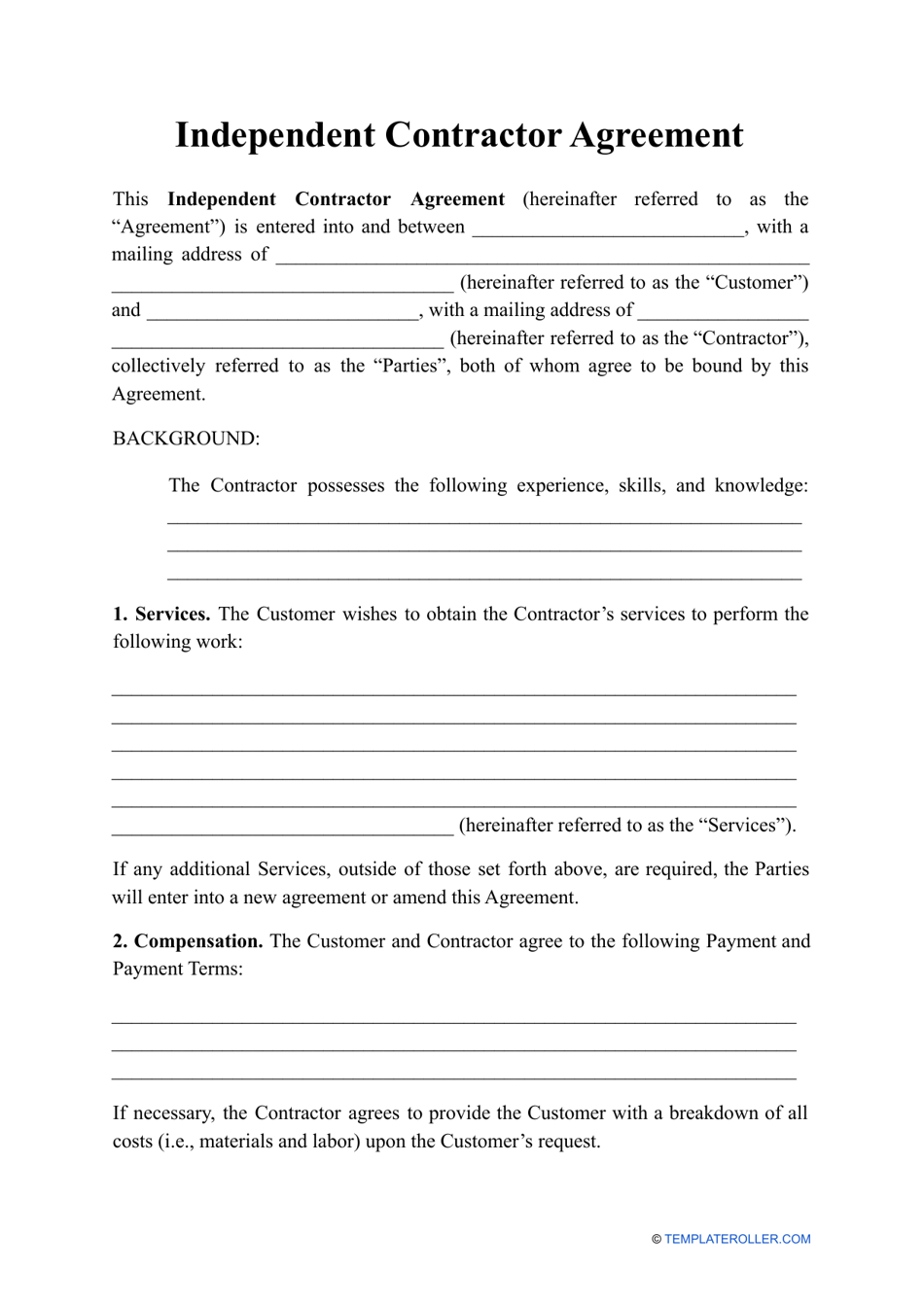

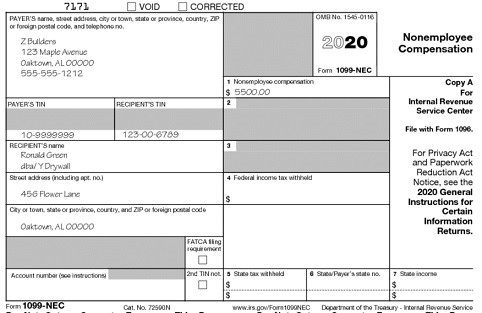

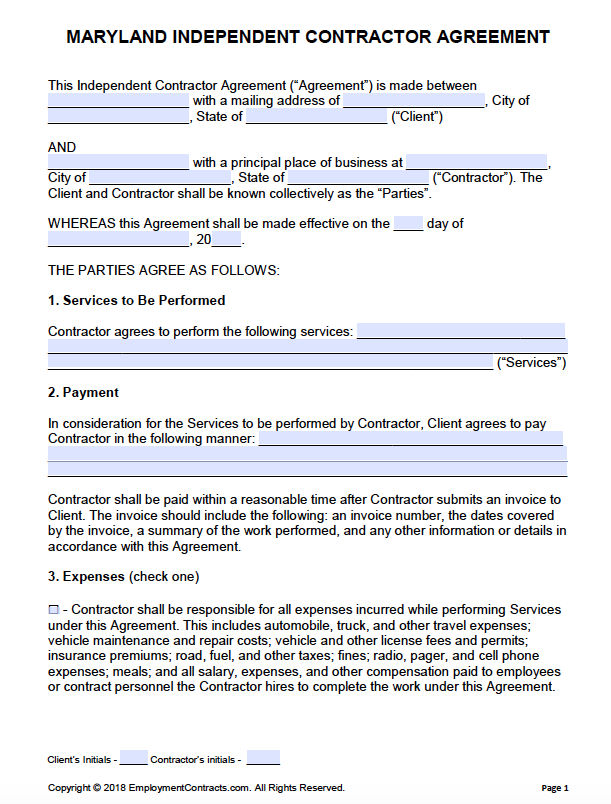

A 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service ( IRS ), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks1099 CONTRACTOR AGREEMENT 1099 CONTRACTOR AGREEMENT AGREEMENT made as of _________________, between Eastmark Consulting, Inc, a MassachusettsCorporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and_________________("Contractor"), Federal Identification (or Social Security) ___________________ You must provide Form 1099NEC to your contractors each year Understanding Form 1099NEC A company must provide a 1099NEC to each contractor who is paid $600 or more in a calendar year Independent contractors must include all payments on a tax return, including payments that total less than $600

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 contractor form 2020

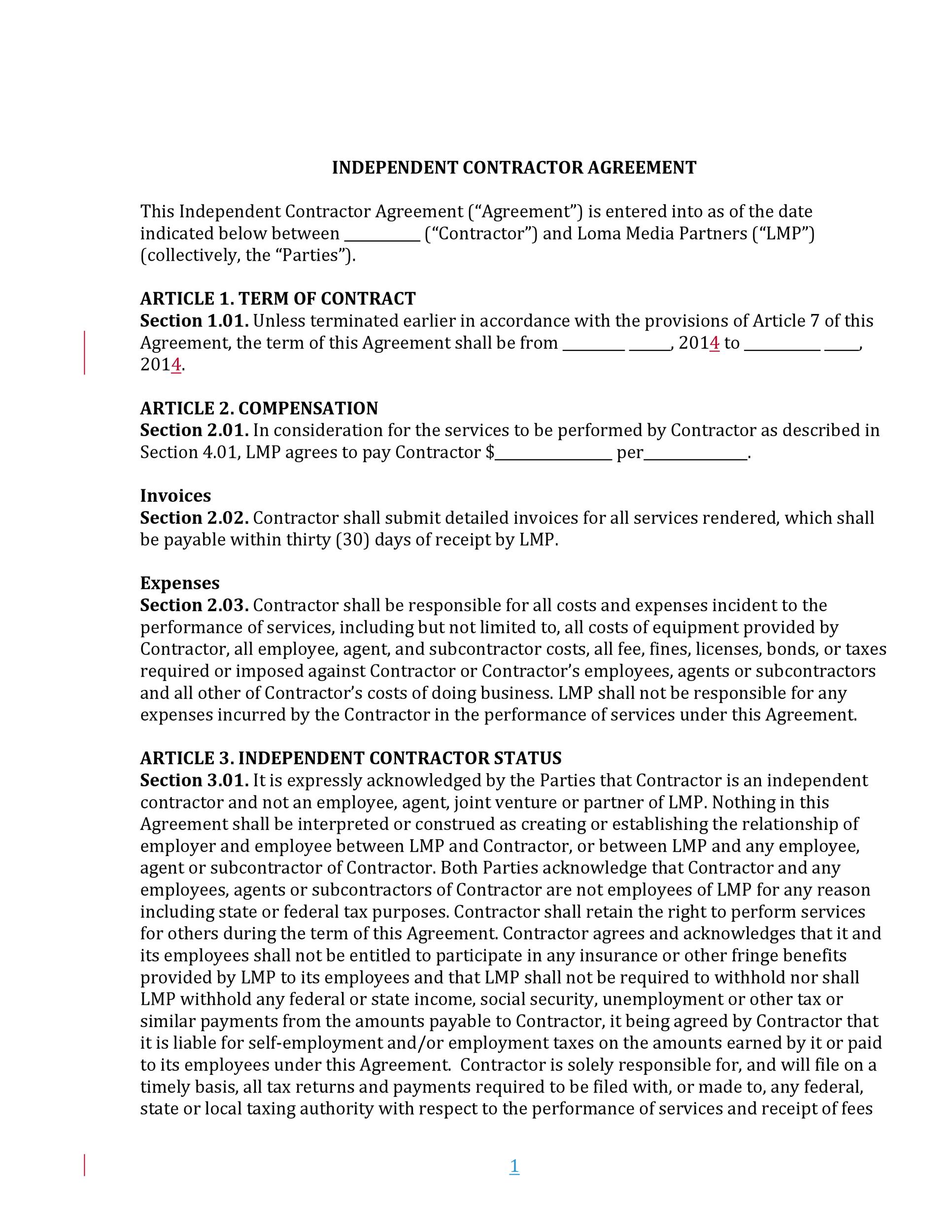

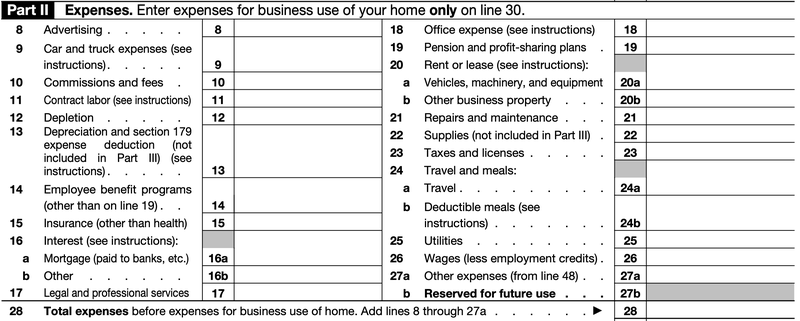

1099 contractor form 2020- 2 IRS Tax Form 1099NEC As of the tax year, the IRS Form 1099NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income Contractors don't have an employer, so they're responsible for paying taxes and reporting their income 1099 contractors must use form 1040 to report income However, contractors have other forms to file too You'll need to report your income and businessrelated expenses on a Schedule C form

What Is A 1099 Contractor With Pictures

Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and Federal 1099 Tax Form for international contractors Did you hire a contractor to perform work? 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment tax

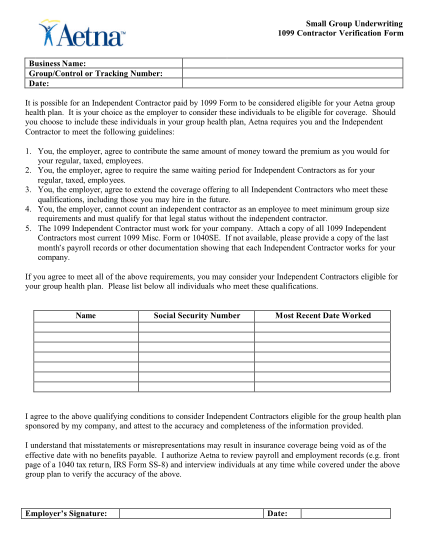

Form 1099MISC is the most common type of 1099 form Companies use it to report income earned by people who work as independent contractors rather thanYou'll need to submit a Form 1099NEC for any US independent contractor who works for your business as a selfemployed individual For nonUS contractors you'll need to fill out Form 1024S The threshold for whether you need to submit a form is whether you have paid the contractor in question $600 during the tax yearThat said, the company should issue a Form 1099NEC (given they paid the contractor more than $600 within a year) as it would to any US resident contractors There are some cases where the tax implications change, so we advise you to take a look at the IRS' Tax Guide for US Citizens and Resident Aliens Abroad or consult their FAQ page about International Individual Tax Matters

If you paid a contractor more than $600 in a calendar year, you are required to report that income to the IRS and issue a form 1099Misc to the vendor Your tax software most likely has everything needed to issue a form 1099 If you have any questions about W9 or 1099 forms, it is always best to consult with a professional business accountantWorkers Compensation Insurance for 1099 Contractors Workers' compensation insurance is a musthave for employers; Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600

Independent Contractor 101 Bastian Accounting For Photographers

3

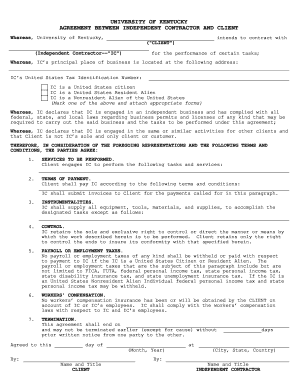

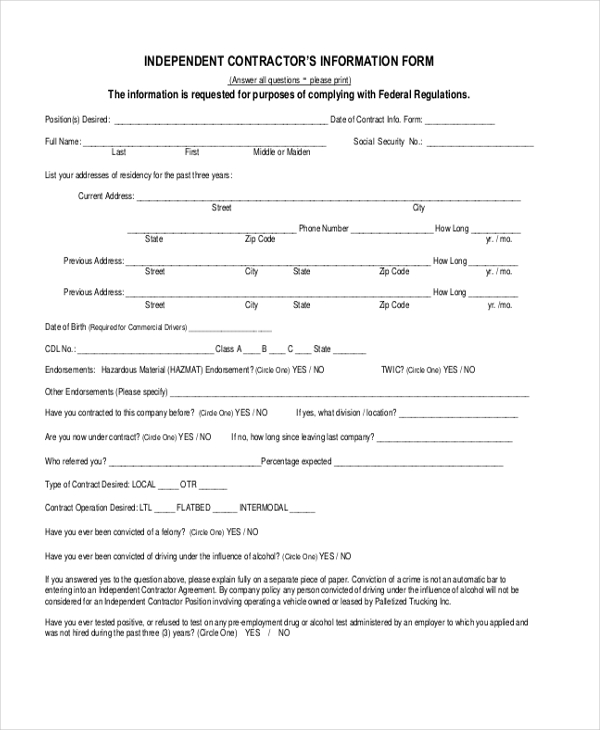

Once you know which contractors you paid over $600 to, you will need to fill out Form 1099NEC Starting at the upper left box, record your organization's name as the PAYER The PAYER TIN is the organization's tax identification number The RECIPIENT'S TIN is the contractor's SSN or business TIN You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files As per the IRS rules, independent contractors must pay 90% of taxes or the equivalent of 100% of last year's tax bill by December Form 1099 online is an IRSauthorized efile provider which helps to report the income paid to the contractors with the respective 1099 Tax Form We provide stepbystep guidance to file tax returns easily

50 Free Independent Contractor Agreement Forms Templates

What Tax Forms Do I Need For An Independent Contractor Legal Io

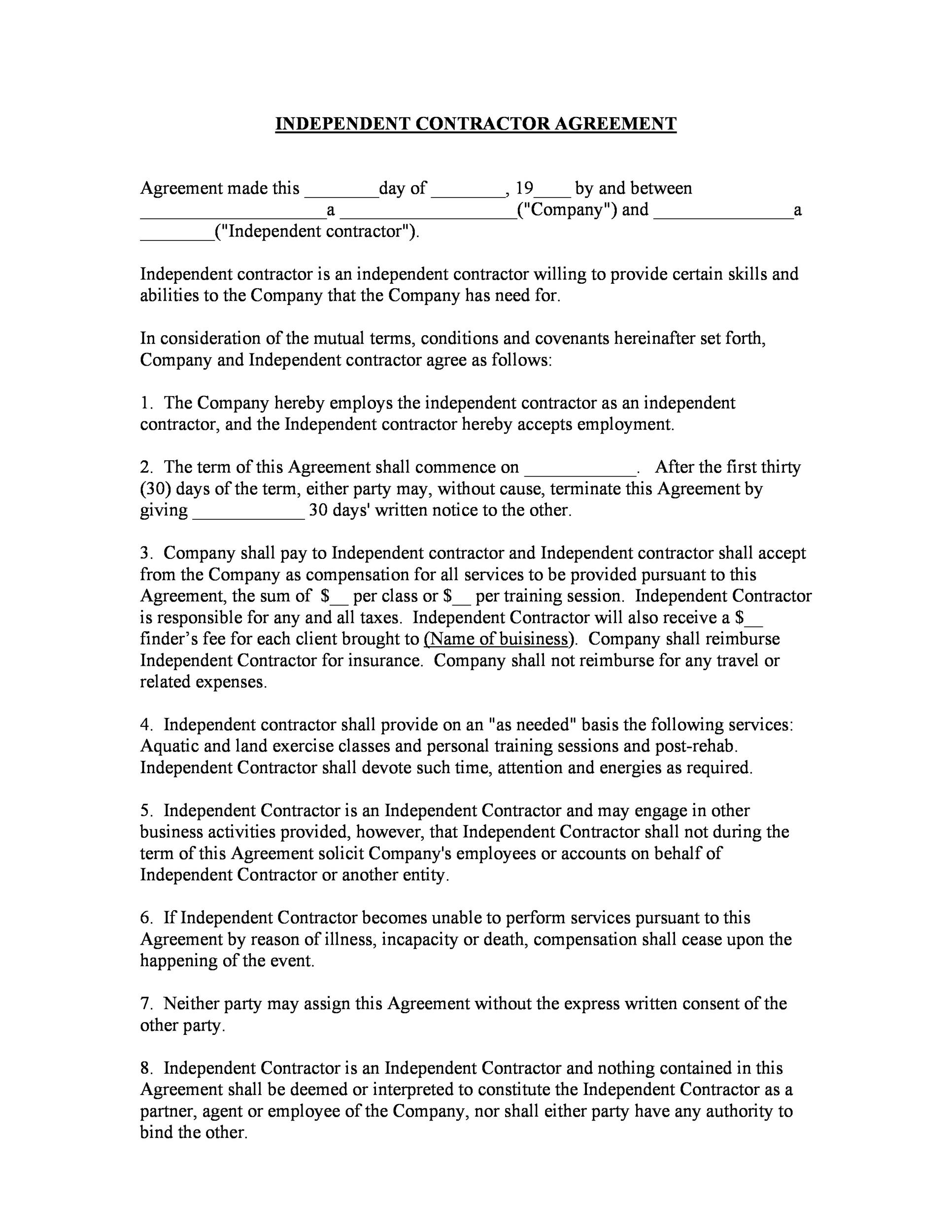

For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated servicesIn fact, it's the law in every state While it may be clear that you have to carry a policy that covers all employees it can get confusing if you also use independent contractors, also known as 1099 contractors, in your businessWhether you're operating business domestically or internationally, you need to report the income paid other than salaries or

Independent Contractor Agreement Texas Fill Online Printable Fillable Blank Pdffiller

1099 Misc Instructions And How To File Square

The step by step guide to filing the Form 1099 MISC is as follows Collect the information for each contractor, and verify them for authenticity Calculate the entire amount paid to the contractor during the year Enter payer's and recipient's name, address, and TIN Fill the applicable boxes in the form Submit Copy A of the Form to the A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of aYou are required to file a Nonemployee Compensation Form (1099NEC) or a Miscellaneous Information Form (1099MISC) for the services performed by the independent contractor You pay the independent contractor $600 or more or enter into a contract for $600 or more The independent contractor is an individual or sole proprietorship

What Is A 1099 Contractor With Pictures

1099 Form Independent Contractor Free

A company is required to file a 1099 form when an independent contractor is paid more than $600 in a given year A company is required to pay half, at 75 percent, of an employee's Social Security tax, but is not similarly obligated for contractors 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxesDoes the contractor is foreignbased?

Contractors Please Claim Your Independence Tax Form 1099

Independent Contractor Vs Employee Exploring The Categories Mu Extension

When you file forms to declare income for your contractors, this becomes a case that is bigger than your own tax return This is because you need to send your contractor a copy of the 1099MISC The contractor will file their copy on their tax return You will need to file yours on your tax return So, these two forms need to be completed The IRS is nothing if not thorough, and they provide the means to estimate quarterly income tax for 1099 contractors You can use the Form 1040ES Estimated Tax Worksheet You may also want to read Publication 505 , Tax Withholding and Estimated Tax and Form 1040ES , Estimated Tax for Individuals explain what you need to know If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's marketplace UpCounsel accepts only the top 5 percent of lawyers to

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Independent Contractor Agreement Free To Print Save Download

This protects both you and the independent contractor Step 4 Send Out IRS Form 1099 You have to file IRS Form 1099 to report taxes on payments to independent contractors This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builderThere is a surprisingly large amount of 1099 forms, but the most common is the Form 1099MISC The IRS uses this form to keep track of miscellaneous income to taxpayers If you worked for someone as an independent contractor, you should receive a 1099MISC form from every person who paid you more than $600 over the course of the year For each independent contractor you paid $600 or more during the year, you must report the total amount paid on Form 1099NEC, beginning with the tax year You must send the 1099NEC form To each independent contractor no later than January 31 of the following year, and

Independent Contractor Agreement In Word And Pdf Formats

Free Independent Contractor Agreement Template What To Avoid

In fact, some independent contractors work below minimum wage 25 Little Known 1099 Independent Contractor Deductions Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies To shed some light and make itemizations a little less "taxing," Keeper Tax has compiled a quick summary of deductions you might qualify for,Contractors receive agreedupon fees for services provided to the client without any withholdings for tax purposes Companies that pay an independent contractor $600 or more for services provided during the year must provide the contractor with a Form 1099

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Instant Form 1099 Generator Create 1099 Easily Form Pros

How to deal with Form 1099 Here's a sight to behold A Form 1099 that's totally blank Typically, when a contractor gets a Form 1099 from a client, some of those blue boxes are going to be filled in—with the contractor's name, address, the TIN they entered on Form Compensation — enter the total previous payments to be reported in Box 7 of Form 1099MISC Reimbursement — enter businessrelated expenses prepaid by the contractor that you paid back to them Any amounts entered here are not reported on Form 1099MISC Select OK Enter the contractor's bank account info then select OK 1099MISC Copy B–For the copy you'll ship to the contractor, you may both fill out a bodily copy of Kind 1099MISC or print off an digital model of Copy B from the IRS web site You should definitely ship the finished kind to the contractor by January 31

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Independent Contractor Agreement Template Free Pdf Sample Formswift

1099 Rules For Business Owners in 21 (updated 1/29/21) Over the past few years, there have been a number of changes and updates regarding the reporting rules for the mysterious 1099 Forms I say "mysterious" because many business owners simply guess as to what the rules are and oftentimes get exasperated and just give up choosing to file nothing at all Taxpayers will receive a Form 1099 via mail if they worked during a given year as a 1099 contractor, and individuals will need to accurately report all 1099 information on their yearly tax return Unlike a standard W2 form, in which an employer files and withholds the appropriate tax dollars on an employee's behalf, for all intents and purposes a 1099 contractor is her or his Simply upload your W9s and we'll file and mail the 1099s for each contractor Form W9 (Request for Taxpayer Identification Number) starts easy by verifying your freelancer's name and address Next, Box 3 (at the top of the form) will let you know how your contractor's business is

Free California Independent Contractor Agreement Pdf Word

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Pay your contractors with multiple compensation types You can fix an amount, pay by hour, or even pay based on the work done by contractors Also Support other 1099 Payments With our software you could also pay any type of Miscellaneous Income that is actually reportable on Form 1099The 1099 is an IRS form that an independent contractor receives stating her income from a given business during a given tax year The 1099 contractor is usually not protected by minimum wage laws;Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

Policy Ucop Edu Doc

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

The 1099 form is for businesses If a contractor does work for you in your private home, it's his responsibility to report the income Even if the same person painted your house and your store, The 1099 form is an information filing form which is used to report nonsalary income to the IRS, for federal tax purposes There are actually different 1099 forms, but the most commonly used is the 1099NEC for reporting contractor payments Previously the 1099MISC was for reporting contractor payments, but the IRS released the new 1099 A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

Download 1099 Forms For Independent Contractors Elegant Fillable 1099 Form 18 Free Printable 1099 Form Best 1099 Misc Form Models Form Ideas

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

My Employer Says I M An Independent Contractor Does L I Cover Me

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

50 Free Independent Contractor Agreement Forms Templates

1

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Independent Contractor 101 Bastian Accounting For Photographers

Independent Contractor 101 Bastian Accounting For Photographers

Independent Contractor Agreement Example

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

Free Texas Independent Contractor Agreement Pdf Word

A 21 Guide To Taxes For Independent Contractors The Blueprint

50 Free Independent Contractor Agreement Forms Templates

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

How To File 1099 Misc For Independent Contractor Checkmark Blog

A 21 Guide To Taxes For Independent Contractors The Blueprint

1099 Form Independent Contractor Agreement Best Of Independent Contractor Agreement Example Simple 16 Independent Models Form Ideas

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Application Fill Online Printable Fillable Blank Pdffiller

Self Employed Vs Independent Contractor What S The Difference

Know Which Irs Form To Use If You Paid Independent Contractors Small Business Trends

50 Free Independent Contractor Agreement Forms Templates

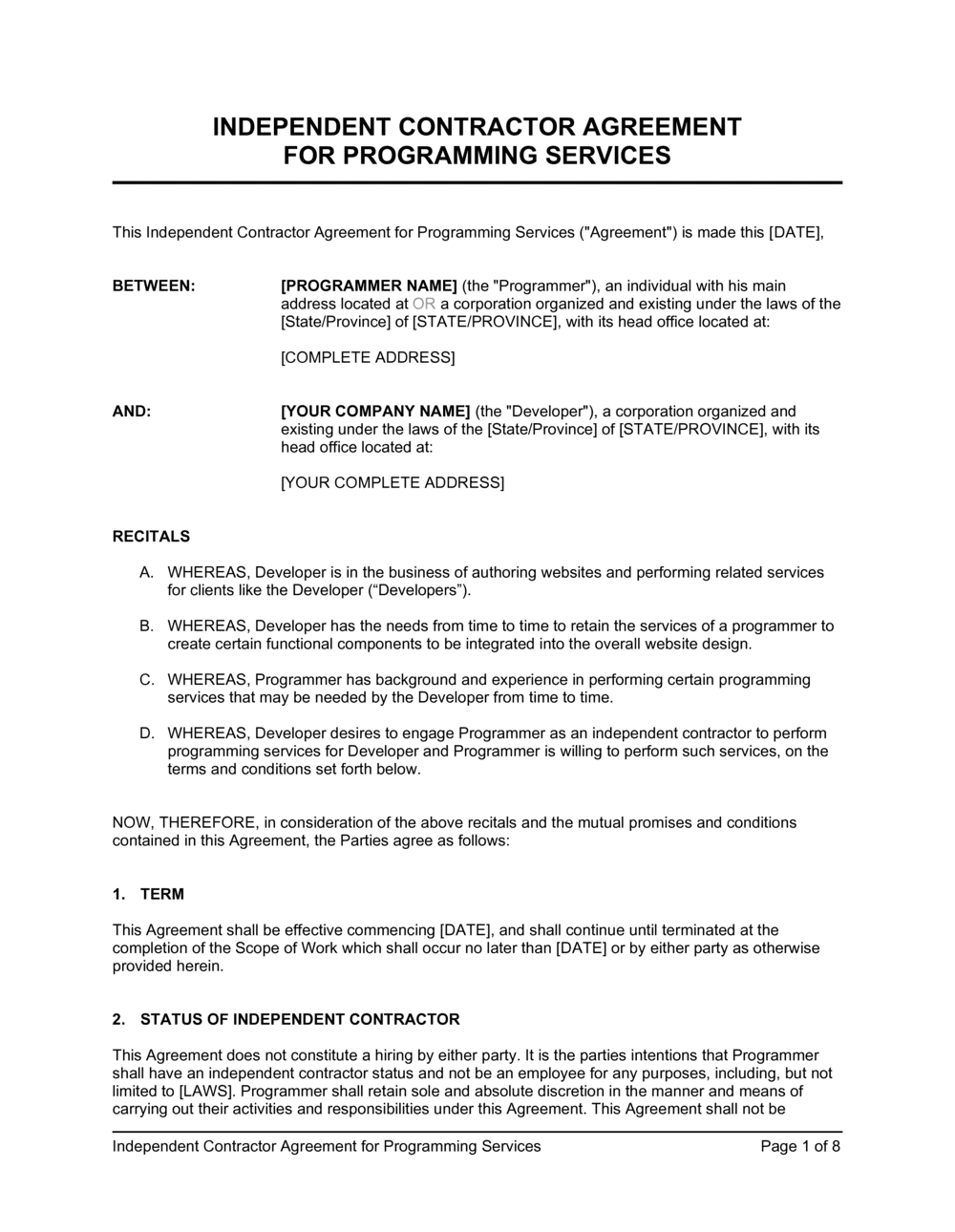

Independent Contractor Agreement For Programming Services Template By Business In A Box

Form 1099 Nec For Nonemployee Compensation H R Block

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Exh10 1 Htm

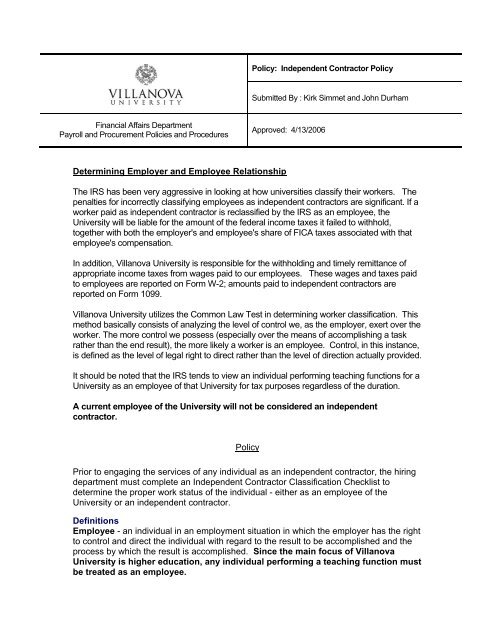

Independent Contractor Policy Villanova University

Independent Contractor Or Employee

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

50 Free Independent Contractor Agreement Forms Templates

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement Templates Word Pdf

What Is Form 1099 Nec

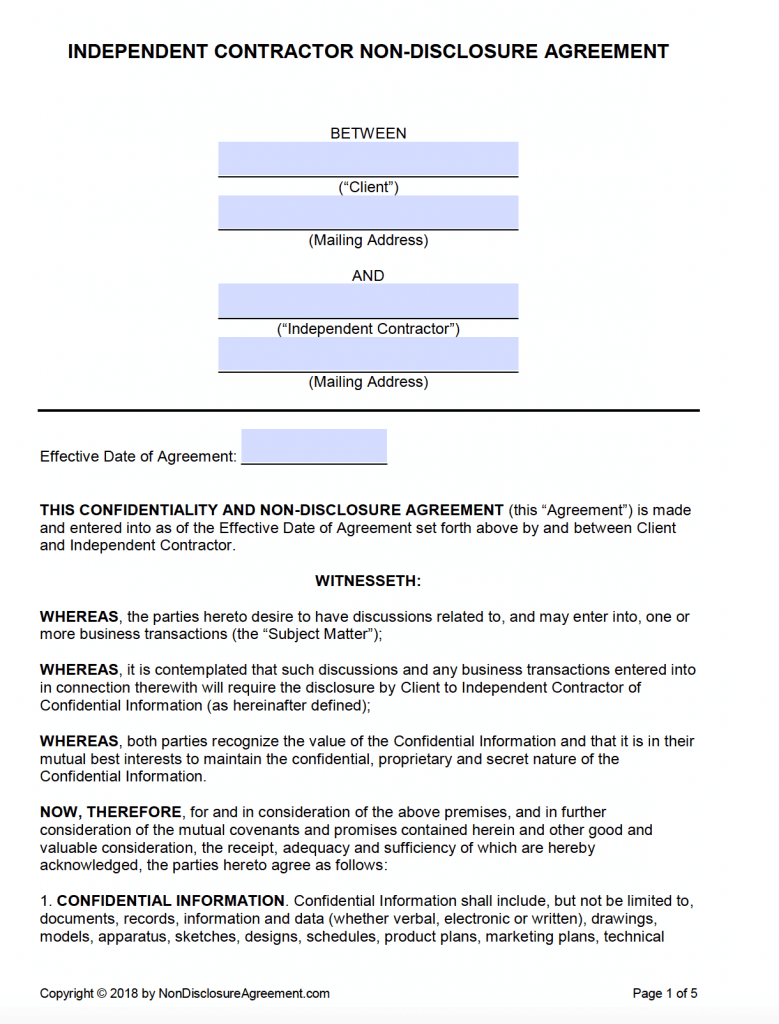

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

3

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

Create An Independent Contractor Agreement Download Print Pdf Word

Who Are Independent Contractors And How Can I Get 1099s For Free

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

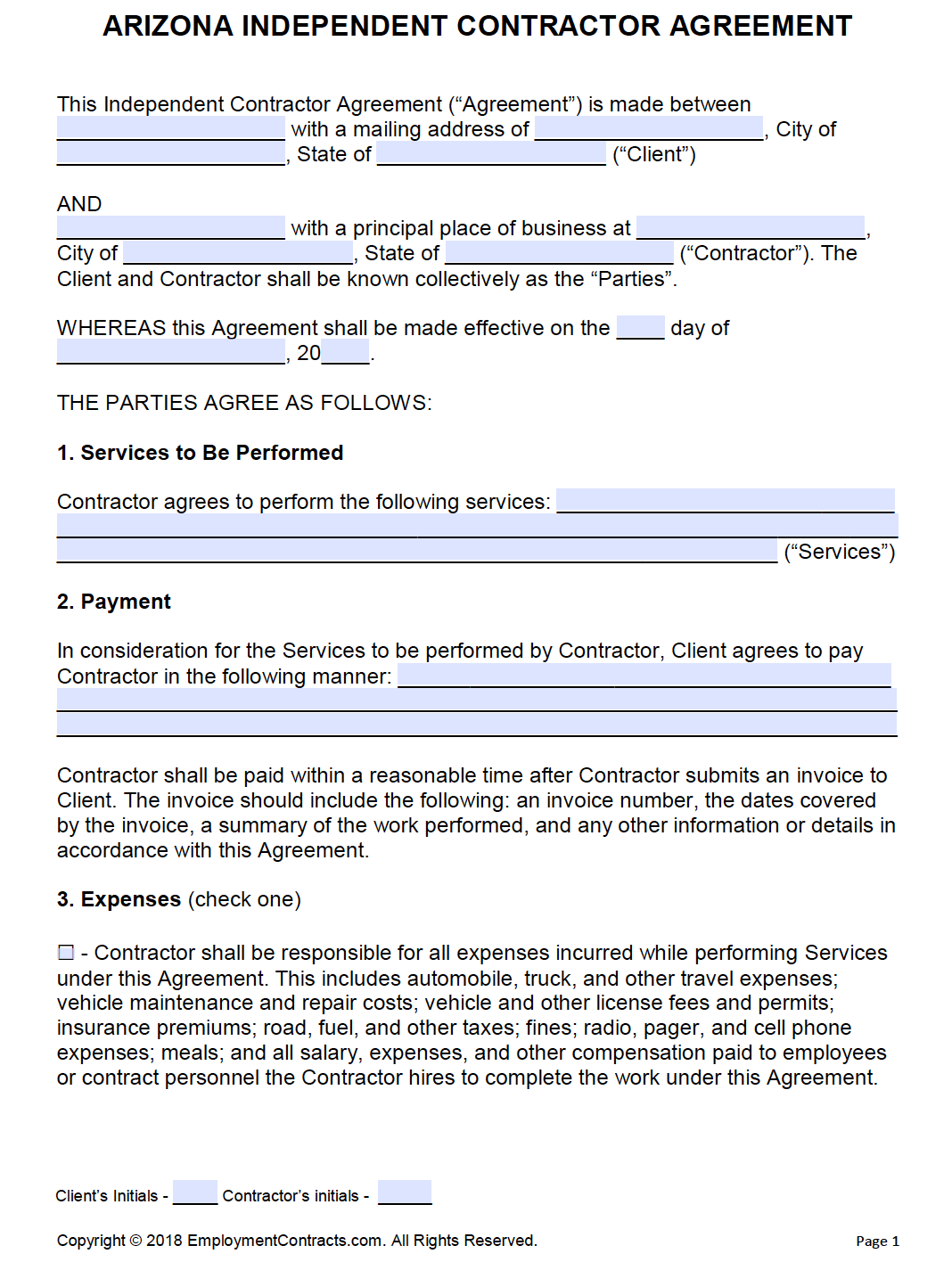

Free Arizona Independent Contractor Agreement Pdf Word

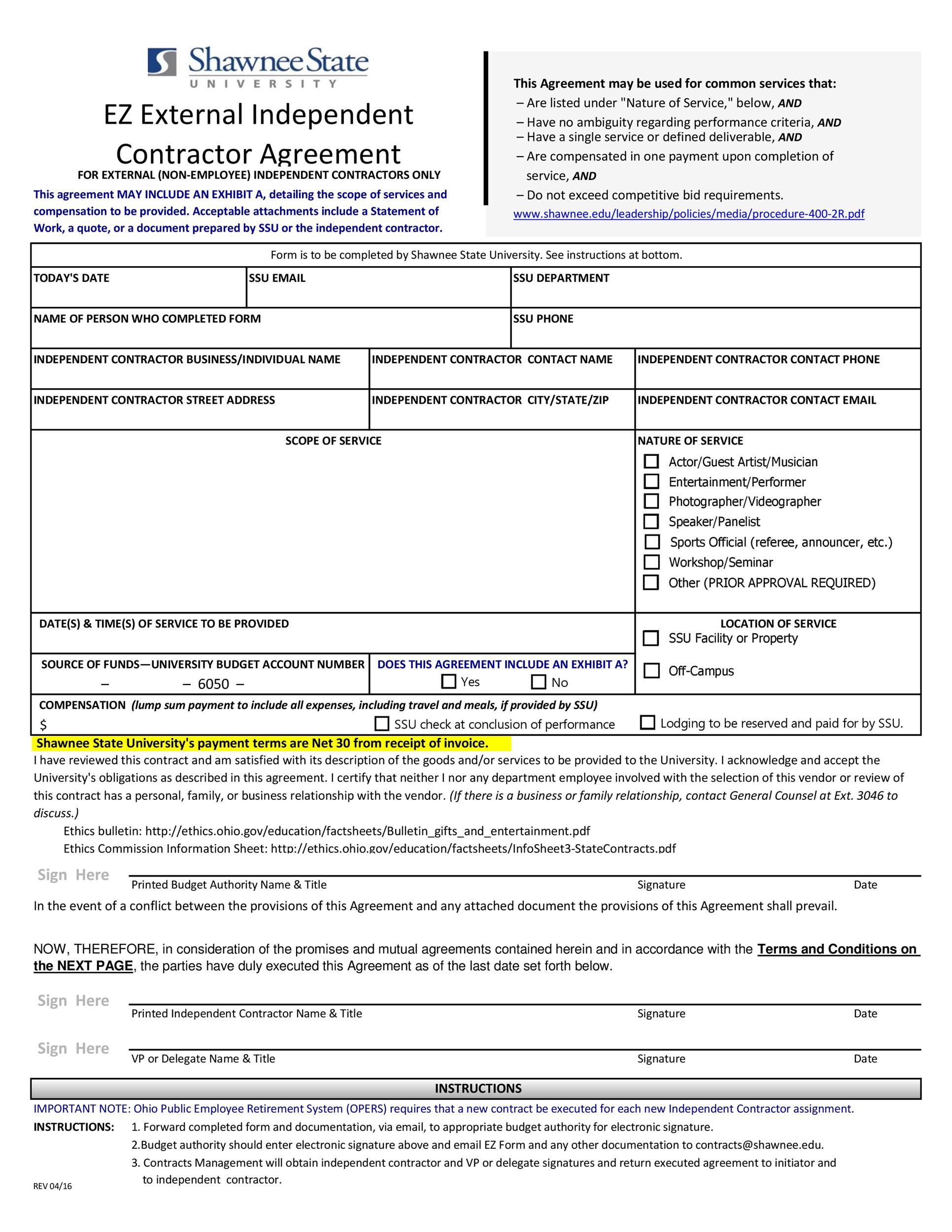

What Forms Do You Need To Hire An Independent Contractor Workest

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

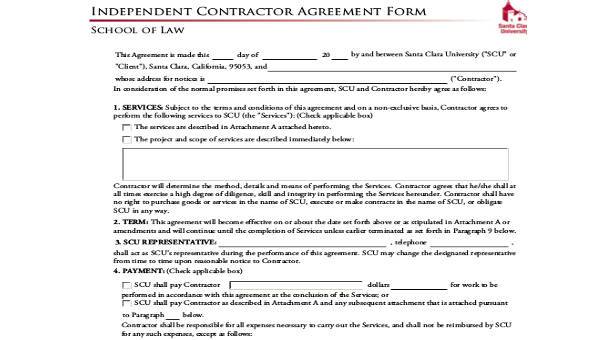

Is Client Service Agreement Same As Independent Contractors Agreement In Us Quora

Free Colorado Independent Contractor Agreement Word Pdf Eforms

1099 Misc Form Reporting Requirements Chicago Accounting Company

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor 101 Bastian Accounting For Photographers

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

50 Free Independent Contractor Agreement Forms Templates

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

50 Free Independent Contractor Agreement Forms Templates

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

1

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Ready For The 1099 Nec

How To Pay Contractors And Freelancers Clockify Blog

Free Maryland Independent Contractor Agreement Pdf Word

Au3hy Tjer4x2m

Free Independent Contractor Agreement Pdf Word

1099 Misc Form Fillable Printable Download Free Instructions

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free Florida Independent Contractor Agreement Pdf Word

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Independent Contractor 101 Bastian Accounting For Photographers

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

What Is The 1099 Form For Small Businesses A Quick Guide

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

0 件のコメント:

コメントを投稿